Table Of Content

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. A real estate attorney can help homebuyers through the closing process to make sure they understand the terms. Then, write down how much money you earn each month (total regular income after all deductions). Before you invest, you should carefully review and consider the investment objectives, risks, charges and expenses of any mutual fund or exchange-traded fund (“ETF”) you are considering.

How to buy a house with bad credit in 2024 - CNN Underscored

How to buy a house with bad credit in 2024.

Posted: Wed, 17 Jan 2024 08:00:00 GMT [source]

Check your home buying eligibility

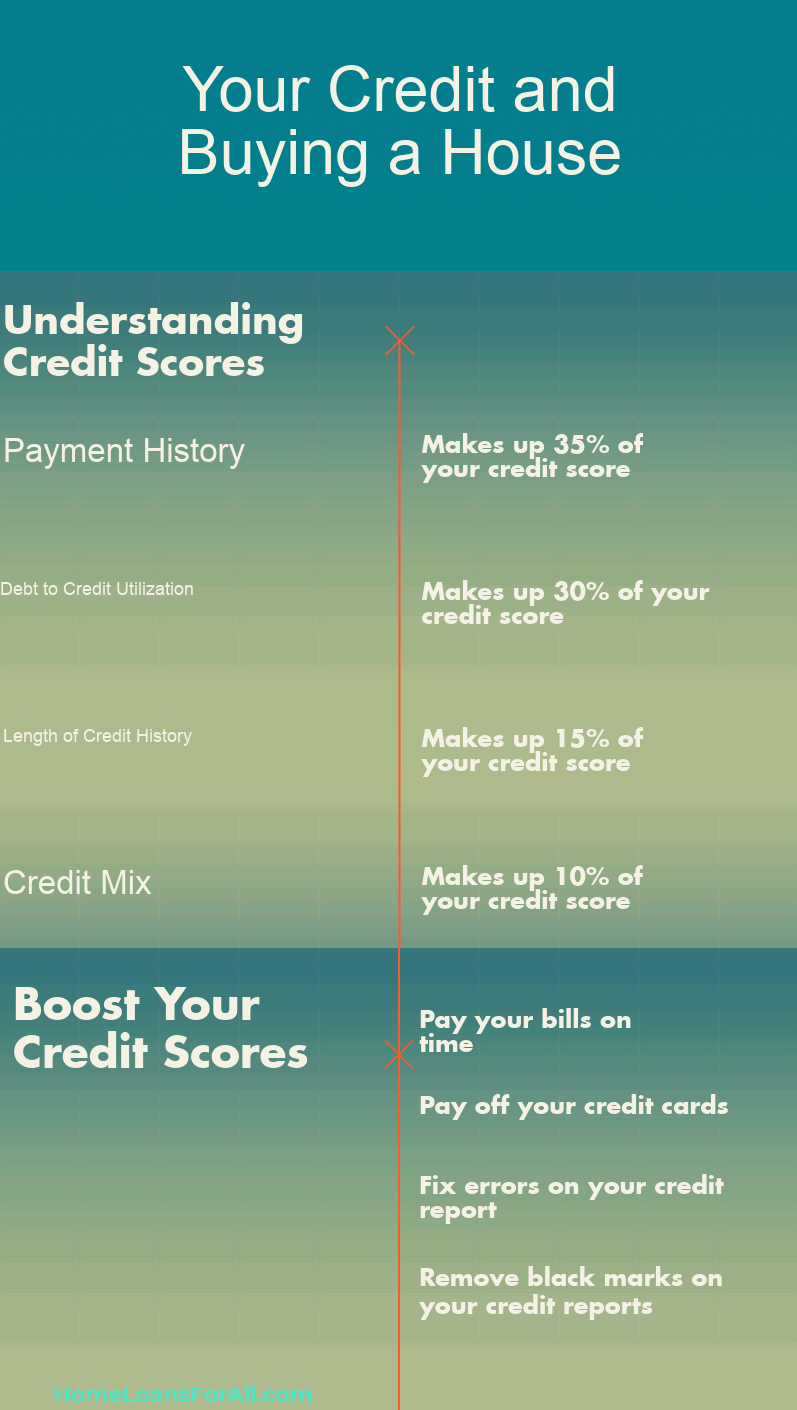

One of the best ways to increase your credit score is to identify any outstanding debt you owe and make payments on that debt until it’s paid in full. First, if your overall debt responsibilities go down, then you have room to take on more, which means you’re less of a risk to your mortgage lender. Your credit report is an essential part of understanding your credit score because it details your credit history. Any mistake on your credit report could lower your score, so it’s important to check your credit report every once in a while, and report any errors to one of the credit reporting agencies. You’re entitled to a free credit report from all three major credit bureaus once a year.

Don’t open any new lines of credit or take out large loans

Your debt-to-income ratio (DTI) is the percentage of your gross monthly income that goes toward paying off debt. Having less debt in relation to your income makes you less risky to lenders, which means you’re able to safely borrow more on your mortgage. Your credit score is a number that’s used to indicate your creditworthiness. The higher your score, the more responsible of a borrower you’ll appear to mortgage lenders.

How Can You Check Your Credit and Monitor Your Progress?

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more. All in all, lenders view borrowers with good credit as a lower risk. Banks can offer lower rates and charges for good-credit home buyers because there’s less probability they’ll lose money on the loan.

Depending on the lender, the credit score requirement ranges from 620 to 640 for 30-year and 15-year fixed-rate loans. Let's say you're hoping to get a 30-year fixed-rate mortgage loan for the average mortgage balance of $236,443. Jumbo loans are mortgages that exceed conforming loan limits — currently $ in most parts of the U.S. Some lenders offer jumbo loans to mortgage borrowers with credit scores as low as 680, but most require 700 or higher. For a conventional loan, the most popular type of mortgage, you'll need a minimum credit score of 620. The purchase price of the home doesn't typically have a direct impact on what credit score you'll need.

Building a consistent history of on-time payments will always be a surefire way to improve your score. It's important to point out that your credit score isn't the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause your mortgage approval to fall through. Paying down your credit card balances also improves your credit utilization ratio, or the amount of money you spend compared to your total credit limit. Lenders look at this ratio to determine how you manage your existing debts. The lower your credit utilization ratio is, the more reliable you appear as a borrower.

How to Get a Mortgage With Bad Credit

For example, FICO pays the most attention to your payment history and the total amount of debt. VantageScore heavily considers your total credit usage, available credit and credit mix. For government-backed loans, you can apply with a credit score as low as 500. Remember, your credit score takes a small ding if the lender does a hard inquiry during the mortgage preapproval process.

How to improve your credit score to buy a house

Rocket Mortgage® is an online mortgage experience developed by the firm formerly known as Quicken Loans®, America’s largest mortgage lender. Rocket Mortgage® makes it easy to get a mortgage — you just tell the company about yourself, your home, your finances and Rocket Mortgage® gives you real interest rates and numbers. You can use Rocket Mortgage® to get approved, ask questions about your mortgage, manage your payments and more. Even a seemingly minor difference in your interest rate can make the difference of thousands of dollars in the long run. For example, if you purchase a home for $300,000 with a 5% down payment and a 7% interest rate, you’ll pay a total of $397,602 in interest over the life of the loan.

According to FICO’s home mortgage rate comparison tool, the borrowers’ potential mortgage rates could differ by about 1.5%. A good credit score generally makes you an attractive borrower because it shows you’ve managed your credit well. And the better your credit scores, the better chance you may have of being approved for a mortgage—and at a lower interest rate. These large home loans exceed conforming limits set by Freddie Mac and Fannie Mae. Borrowers usually need a down payment of 10% or more and a credit score of at least 680 – for a loan of $1.5 million or less, the minimum median credit score is 720. These loans are available to veterans of the U.S. armed forces, spouses, and active military personnel.

You also need enough cash reserves to cover six to 18 months of mortgage payments. Because jumbo loans are for larger amounts of money—and lenders are taking a bigger risk—the requirements are considerably more stringent than those of smaller loans. USDA loans were created to help households with very low to moderate incomes purchase safe and affordable homes in rural areas. If you’re seeking to buy a home in a rural area, you may qualify, but if you’re house hunting in a metropolitan area it’s unlikely to meet USDA loan requirements. You can visit the USDA’s website and enter an address to find out if a particular property qualifies for a USDA loan. It's possible, but challenging, to buy a house without a credit score.

Although most lending programs cap your DTI at 45%, a high credit score may allow exceptions up to 50%. However, remember that the cost of borrowing with a low credit score could be much higher than it would be if you waited to improve your credit first. If you’re not in a rush to purchase a home, it could be worth it to focus on building your credit first to qualify for a lower rate and better terms in the future. [It] makes a big difference in [the] interest rates and fees you will pay for the loan. The lower [your] credit [score], the higher the interest rate and fees,” says Cenaca Cyprian, CEO of Quality Lending Group. VA loans backed by the Department of Veterans Affairs are designed to help veterans, current servicemembers and eligible surviving spouses access better terms on home loans.

But, so far I'm still using a credit card, the most travelling I've done has been to work and back and there is still no rock on my finger. I have been given an annual pay rise, though, and would say I am less stressed. Los Angeles is the second-most populous city in the U.S., and it's one of the most diverse, both socially and economically. Credit scores in the city, as well as income and debt there, are key indicators of that economic diversity. If your credit utilization rises above 30%, it can start to negatively impact your score, according to Experian.

Mortgage underwriters may look more favorably on an application with a very low DTI ratio, even if your credit history has some bumps in it. This is your only choice if you’re borrowing above the conforming loan limits, and these loans are more common in expensive cities throughout the country. Most jumbo loan programs require a credit score of at least 700, although there may be programs with lower score limits if you can afford a higher interest rate and payment.

That’s well within the range of what mortgage lenders consider to be “good.” In fact, most lenders see any FICO score above 680 as a good credit score to buy a house. You’ll generally need a credit score of 620 or better to qualify for a fixed-rate conforming loan while ARMs typically require a score of 640 or higher. If you’re looking for a jumbo loan, you’ll usually need a score of at least 700 to get approved.

If you’re applying for a mortgage with bad credit, you may need to adjust other metrics to improve your chances of being approved. Buying a house is a big deal, which is why it is important to know where your credit score stands and what it needs to be in order to be approved by the lender of your choice. Your credit score serves as a reflection of your creditworthiness, providing lenders with an insight into your past behavior toward managing debt. Keep in mind that your mortgage rate is determined by multiple factors —your credit score is just one of these. Lenders also consider your income and employment status, which don’t affect your credit score one way or the other.

A low credit score signals higher risk and will translate to a higher interest rate. So while it's important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation. Check with a lender to find out if your credit score and full financial picture make you eligible to buy a house. She has been writing and editing professionally for 20 years and holds an undergraduate degree in print journalism and a graduate degree in journalism and media studies.