Table Of Content

- Check your credit report and correct any errors

- How to calculate debt-to-income ratio and what it means

- Additional Resources for Buying and Selling

- Can Credit Karma Help Me Improve My Credit Score?

- Money: Manifestation warning as people swear it's bagged them '£2,000 in bank account'

- Estimated monthly payment

CreditWise Alerts are based on changes to your TransUnion and Experian® credit reports and information we find on the dark web. The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Whatever you do, make it a priority to put your credit history in order before you apply, and continue to monitor your credit after you buy to continue to build and maintain good credit. You can get a free copy of your credit report from Experian, or from each of the three national credit reporting agencies weekly at AnnualCreditReport.com.

Check your credit report and correct any errors

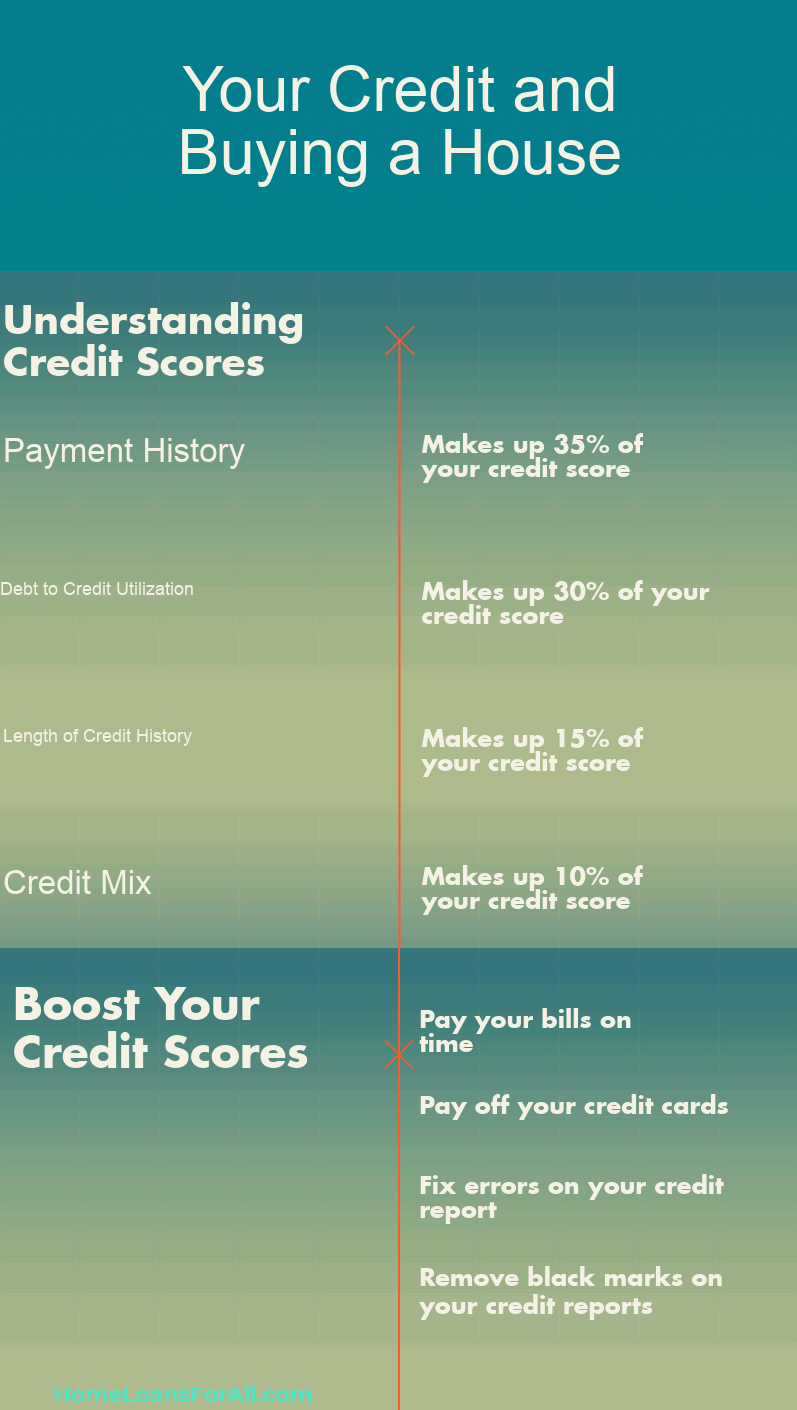

Department of Agriculture, USDA loans don't have a minimum credit score set by the federal agency, but lenders typically require a score of at least 580. These loans are meant for low- and moderate-income homebuyers looking to purchase a home in rural areas. Most people know how important credit scores are when it comes to buying a house. But credit isn’t the only factor lenders consider when approving your home loan.

Mortgage rates top 7% — is this a good time to buy a house? - Yahoo Finance

Mortgage rates top 7% — is this a good time to buy a house?.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

How to calculate debt-to-income ratio and what it means

A credit score that’s considered “good” or better may help you qualify for lower mortgage interest rates, according to the CFPB. The CFPB says people with credit scores in the mid-700s or beyond qualify for the best mortgage rates. Mortgages insured by the Federal Housing Administration (FHA) are designed for people with less-than-perfect credit. These loans require smaller down payments than other types of mortgages. A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called "consumer credit." Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan.

Additional Resources for Buying and Selling

She explained that some people will be very specific with their desires, like selecting a photo of the exact car they want, or the perfect house, but that isn't how manifestation works. There needs to be an element of trust in the universe giving them what they attract. He famously wrote himself a $10m cheque for "acting services rendered" and dated it years in advance. Then in 1995, he was told he was going to make the exact amount for filming Dumb and Dumber. Several technology companies, including Snap Inc., have headquarters here.

Some of the offers on this page may not be available through our website. Once you have your reports, read through them and watch for items you don't recognize or you believe to be inaccurate. If you find any inaccuracies, you can ask your lender to update their information with the credit reporting agencies or dispute the items directly with the agencies. This process can improve your score quickly if it results in a negative item being removed. If you're thinking about buying a home soon, it may be worth spending some time getting your credit ready before you officially begin the process. Here are actions you can start taking now, some of which can improve your credit score relatively quickly.

Money: Manifestation warning as people swear it's bagged them '£2,000 in bank account'

720 Credit Score: Is It Good or Bad? - NerdWallet

720 Credit Score: Is It Good or Bad?.

Posted: Wed, 06 Mar 2024 08:00:00 GMT [source]

Finally, if you’re considering using a co-signer for your mortgage, only do so if you’re certain you’ll be able to repay the loan. If you have late or missed payments—or worse, default on your loan—you’ll negatively impact your co-signer’s credit as well as your own. If your credit score isn’t sufficient to qualify on your own, you could improve your chances by applying with a co-signer or co-borrower. It provides an indicator of your ability to repay your loan, as well as your likelihood of actually doing so.

Disputing Errors on Your Credit Report

Her career includes working as a staff writer for The Atlanta Journal-Constitution, Fortune, Better Homes & Gardens, Real Simple, Parents, and Health. She was also a longtime contributor for TheStreet and her work regularly appears on Bankrate. When she's not busy writing about money topics, Mia can be found globetrotting with her son. Yes, it’s possible to buy a house with a low credit score if you have sufficient income.

So the better your credit is, the cheaper your mortgage loan will be. Home buyers and homeowners have a number of different mortgage programs from which to choose. In addition, each lender may set its own credit score requirement based on its tolerance for risk.

Estimated monthly payment

If you find mistakes on your credit reports, you can dispute any errors with the credit bureau under the Fair Credit Reporting Act. You can use the following guides to send disputes to the credit bureaus and request the removal of any errors from your credit reports. According to the Consumer Financial Protection Bureau (CFPB), a mortgage with a 8.625% interest rate costs more than $105,000 more over 30 years than a mortgage with a 6.25% interest rate. An FHA loan is a type of mortgage that's backed by the Federal Housing Administration. Many consider an excellent credit score to range between 740 and 850. A score above 800 is exceptional and more challenging to achieve.

Review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Options investors may lose the entire amount of their investment or more in a relatively short period of time. Ally Invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence.

Doing so could save you tens of thousands of dollars over the duration of your loan. Since conventional mortgages are backed by private lenders (typically a bank, credit union or direct lender), they have the strictest credit score requirements. Thankfully, buyers with excellent credit scores (over 800) aren’t the only ones who qualify for mortgage loans. Most lenders consider scores of 740 to be “very good,” while still accepting buyers with credit scores as low as 500, depending on the loan type. They use this information to assess whether you have the financial resources to repay the loan. The credit score needed for a $250,000 house varies depending on the type of loan you’re seeking.

With CreditWise from Capital One, you can access your free TransUnion® credit report and VantageScore 3.0 credit score anytime—even if you’re not a Capital One account holder. Keep in mind that there are multiple credit scores and scoring models. And scoring companies like FICO and VantageScore® have different versions of their own scores. So you might see slight differences in your scores depending on what model was used.

Lenders will prioritize the co-signer’s credit and financials when assessing the application. Improving your credit score is the best way to make refinancing more accessible. These quick tips can put you on the right path to raising your credit. "It is about paying your bills on time every single time, keeping your balances as low as possible and not applying for too much credit too often," he says.

ETF trading prices may not necessarily reflect the net asset value of the underlying securities. A mutual fund/ETF prospectus contains this and other information and can be obtained by emailing . Waiting could also be worthwhile when the housing market is hot, or if interest rates are on the rise. Depending on how much flexibility you have, you may benefit from waiting until the market cools off, giving buyers more leverage than sellers, or until interest rates start to decline again. Banking services provided by Community Federal Savings Bank, Member FDIC. The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone.

Your credit score is one of the most significant factors behind the mortgage rates you’re offered. In general, borrowers with higher credit scores are seen as less of a risk by lenders, which results in lower rates for those with good to excellent credit scores. Unlike with FHA loans, the USDA doesn’t have a specific credit score requirement for a USDA mortgage. However, private lenders that offer these loans typically set their own eligibility criteria.

No comments:

Post a Comment